Settle with Hunt and Henriques by following their guidelines and negotiating a repayment plan directly with them. When dealing with debt collection, it is essential to understand that communication and negotiation can help resolve the situation in a mutually beneficial manner.

The key is to be proactive, transparent, and realistic about your financial situation while working towards a solution that works for both parties involved. This article will provide you with practical tips on how to settle your debts with Hunt and Henriques, ensuring a smoother and more manageable financial future.

Understanding Hunt And Henriques

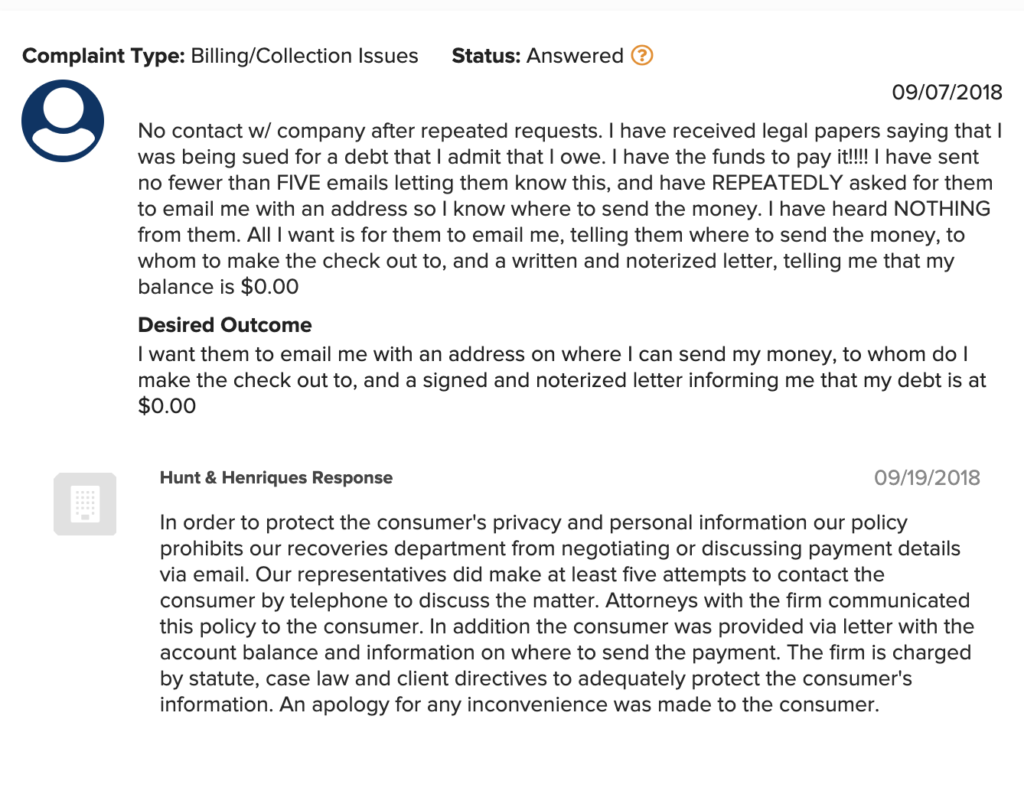

Hunt and Henriques is a well-known law firm based in California that specializes in debt collection. If you find yourself in a situation where you owe money to this firm, it is important to have a clear understanding of who they are and what your options are for settling your debt.

Who Are Hunt And Henriques?

Hunt and Henriques is a law firm that primarily focuses on debt collection and creditor rights. They represent a wide range of clients, including credit card companies, medical providers, and other businesses. They are known for their aggressive approach to debt collection and their extensive experience in this field.

What Types Of Settlements Can Be Made With Hunt And Henriques?

If you are dealing with debt owed to Hunt and Henriques, there are several options available for settling your debt. It is important to understand these options so that you can make an informed decision on the best approach for your situation.

1. Lump-sum payment: One option is to negotiate a lump-sum payment to settle your debt. This involves paying a single, one-time amount to Hunt and Henriques to satisfy your debt in full. This can often result in a significant reduction in the total amount owed.

2. Payment plan: If you are unable to make a lump-sum payment, you may be able to negotiate a payment plan with Hunt and Henriques. This involves setting up a schedule of monthly payments to gradually pay off the debt. It is important to negotiate terms that are realistic and affordable for you.

3. Debt settlement: Another option is to negotiate a debt settlement agreement with Hunt and Henriques. This involves offering to pay a reduced amount to satisfy your debt. Hunt and Henriques may be willing to accept a lower payment if it means they can avoid the time and expense of pursuing further collection efforts.

4. Dispute resolution: In some cases, it may be possible to dispute the validity of the debt or the amount owed. If you have evidence to support your claim, such as incorrect billing or disputed charges, you may be able to negotiate a resolution with Hunt and Henriques.

It is important to consult with a legal professional to understand your rights and options when dealing with debt owed to Hunt and Henriques. They will be able to provide you with guidance and representation throughout the process of settling your debt.

Preparing For Settlement

To settle with Hunt and Henriques, start by gathering all necessary documents related to the debt. Contact the firm to negotiate a payment plan or lump-sum settlement. Be prepared to provide proof of financial hardship and present a clear, reasonable proposal for repayment.

Gathering Necessary Documentation

Gathering the necessary documentation is a crucial step when preparing for settlement with Hunt and Henriques. It is important to have all the relevant paperwork in order to effectively negotiate and settle your debt. By having the necessary documentation ready, you can present a strong case and increase your chances of reaching a favorable settlement agreement.

When it comes to gathering the required documentation, you should start by compiling all the paperwork related to your debt. This includes any letters, notification of collections, bills, statements, or any other documentation that proves your debt and the amount owed. Having a complete record not only helps you in negotiations, but it also ensures that you have accurate information about your debt.

In addition to the debt-related documentation, you should also gather any supporting documentation that can strengthen your negotiating position. This may include your income information, bank statements, and any other supporting documents that demonstrate your current financial situation. By showing your ability to pay, you can potentially negotiate for a lower settlement amount.

Understanding Negotiation Strategies

Understanding negotiation strategies is essential when settling with Hunt and Henriques. By familiarizing yourself with effective negotiation techniques, you can increase your chances of reaching a favorable settlement agreement.

One key negotiation strategy to keep in mind is to always be prepared. This includes doing thorough research on your debt, understanding your rights as a debtor, and being knowledgeable about the debt collection process. By being well-informed, you can confidently negotiate and advocate for yourself during the settlement process.

Another important strategy is to stay calm and composed during negotiations. Emotions can often cloud judgment and hinder a successful settlement. By maintaining a calm demeanor, you can think clearly and make rational decisions that are in your best interest.

Furthermore, it is crucial to have a clear goal in mind before entering into negotiations. This includes determining the maximum amount you are willing and able to pay as a settlement. Having a clear goal helps guide your negotiation efforts and prevents you from agreeing to terms that may not be in your favor.

Lastly, effective communication plays a vital role in negotiation. It is important to clearly articulate your position and reasons for seeking a settlement. Additionally, actively listening to the other party’s perspective can help build rapport and potentially lead to a mutually beneficial agreement.

Negotiating With Hunt And Henriques

Learn effective techniques for settling with Hunt and Henriques through successful negotiations. Gain insights on how to navigate the process and achieve a favorable outcome. Trust our expert guidance to help you reach a settlement with confidence.

Opening Discussions

If you’ve received a debt collection notice from Hunt and Henriques, it’s essential to approach the situation strategically. Initiate the negotiation process by requesting validation of the debt. Communicate with the firm in a professional and polite manner, seeking information on the debt they claim you owe. Remain calm and assertive in your communication to maintain control of the conversation.

Presenting A Settlement Offer

When negotiating with Hunt and Henriques, prepare a settlement offer that you can afford. Clearly outline your proposal, including the amount you wish to settle for and the timeline for making the payment. Ensure that your offer is reasonable and reflects your current financial situation. Avoid making promises that you cannot fulfill.

Highlight the benefits of accepting your offer, emphasizing the possibility of receiving immediate payment and avoiding the elongated legal process. Be firm, yet accommodating, in your approach, expressing your willingness to resolve the matter amicably while considering your financial constraints.

Credit: www.suethecollector.com

Reaching A Settlement Agreement

Final steps include offering payment flexibility if needed by the debtor.

- Agree on a reasonable lump sum amount

- Determine acceptable payment terms

- Specify a deadline for payment completion

Ensuring Legal Compliance

It is essential to ensure the settlement agreement aligns with legal requirements:

- Review applicable laws and regulations

- Include all necessary clauses in the agreement

- Seek legal guidance if unsure about compliance

Post-settlement Considerations

Financial Obligations

After settling with Hunt And Henriques, ensure timely payments of agreed settlements.

Prioritize fulfilling financial commitments to prevent any future legal actions.

Record-keeping And Follow-up

Maintain detailed records of all communications and transactions post-settlement.

Regularly follow up to confirm settlement status and any outstanding obligations.

Credit: www.suethecollector.com

Credit: www.creditinfocenter.com

Frequently Asked Questions On How To Settle With Hunt And Henriques

How Do You Deal With Hunt And Henriques?

To deal with Hunt and Henriques, follow these steps: 1. Understand their needs and expectations. 2. Communicate effectively and transparently. 3. Provide high-quality services or products. 4. Address any issues or concerns promptly and professionally. 5. Build a strong relationship based on trust and collaboration.

How Much Will A Debt Collector Settle For?

Debt collectors usually settle for 50-80% of the total amount owed. It varies case by case.

What Percentage Should I Offer To Settle Debt?

For debt settlement, aim to offer around 30-50% of the total amount owed.

Is Hunt And Henriques Debt Collectors?

Yes, Hunt and Henriques are debt collectors. They specialize in collecting debts on behalf of creditors.

Conclusion

Settling with Hunt And Henriques requires careful planning and negotiation. Understanding your rights and responsibilities is crucial for a successful resolution. By working with a reputable legal professional and staying informed about your options, you can navigate the process effectively and achieve a favorable outcome.